Medium-Term Business Plan (FY 2024-2027)

NS United Kaiun Kaisha, Ltd. hereby announces that the company has formulated a Medium-Term Business Plan "FORWARD 2030 II Challenge for innovation and further growth with U", starting in fiscal year 2024.

We will embark on a growth strategy based on the financial ground built by implementing key strategies of previous Medium-Term Business Plan. Through the implementation of the Medium-Term Business Plan.

Through the implementation of the Medium-Term Business Plan, we will take another step toward sustainable growth and maximizing corporate value.

Positioning of Medium-Term Business Plan

Click to enlarge

2030 Vinson

Aiming to become an indispensable presence

for clean and sustainable

marine transportation services,

we will continue to transform ourselves

in cooperation with stakeholders

and further enhance our corporate value.

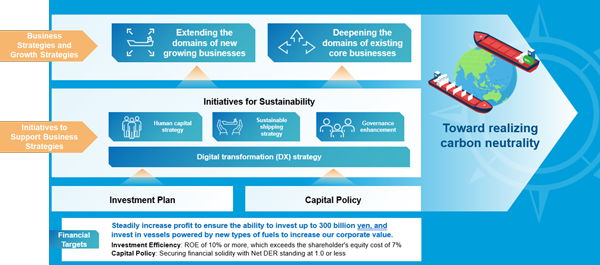

Strategies for Achieving the 2030 Vinson

Click to enlarge

Business Strategies and Growth Strategies

Extending the Domains of New Growing Businesses

In order to realize carbon neutrality, we will expand our business domain through the development of new cargo shipping fleets by accurately analyzing changes in demand for both coastal and international maritime transportation, including future increases in transportation demand for reduced iron, scrap, and liquefied CO2 due to the decarbonization of the steel manufacturing process, and the expansion of new demand for liquid bulk transportation, such as ammonia and hydrogen, which are expected to be next-generation energy sources.

Deepening the Domains of Existing Core Businesses

We will promptly deploy methanol dual-fuel (DF) vessels and collaborate with our customers in environmental measures, thereby securing stable revenue through long-term contracts. We also aim to secure long-term contracts with our overseas customers with our methanol-DF fleet.

In addition, we will make further approach in India and Southeast Asia, where economic growth is expected. We will establish a representative office in Thailand in 2024.

In addition to the Singapore office, which aims to expand into India, the representative office in Thailand plans to improve the quality of transportation by taking care of steel products exported from Japan, and to develop the office as a new base for shipments to and from Southeast Asia.

Initiatives to Support Business Strategies

Financial Targets

Aim to achieve ROE of 10% or more by accumulating profit from growth strategies as well as from stable return businesses.

| FY 2027 | FY 2030 | |

|---|---|---|

| Consolidated Operating Income | 20 billion yen | We aim to achieve an ROE of at least 10% or more, which is well above the 7% cost of equity, through continuous profit growth, while maintaining financial discipline at 1.0 time Net DER or less. |

| ROE | 10% | |

| Net DER | 1.0 times or less |

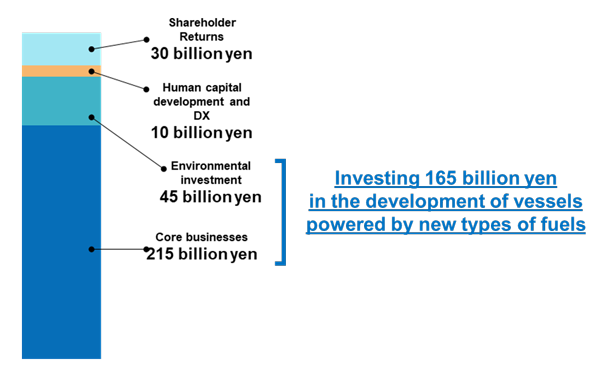

Investment Plan

In addition to the stable return business, we will steadily increase profits from our growth strategies and build up our operating cash flow by 2030, while keeping Net DER under 1.0 time, we will leverage our finances to invest in a scale approaching ¥300 billion, with the aim of strengthening return stability and achieving medium- to long-term returns growth.

We will invest ¥215 billion in core businesses such as the replacement of existing vessels, ¥45 billion in environmental investments such as the conversion to methanol-fueled DF and the securing stable biofuel supply, and ¥10 billion in human resource development and DX-related investments such as the establishment of a seafarer training center.

Of this, we plan to invest ¥165 billion in the vessels powered by new types of fuels such as methanol-fueled DF ships.

Investment Plan (FY 2024 to 2030)

Shareholder Returns

While securing retained earnings to generate sustainable corporate growth and respond to changes in operating environment, our policy is to maintain sustainable dividend distribution in accordance with the company's performance. We will consider further strengthening shareholder returns with a benchmark payout ratio of 30%.