Based on our corporate philosophy of contributing to the development of society by providing trusted and high-quality marine transportation services, our Group strives for its sustainable growth and to improve corporate value over the medium to long term while responding to the expectations and earning the trust of shareholders, customers, and all other stakeholders. To this end, we developed corporate governance systems suited to the characteristics of our Group's operations.

These systems are continuously reviewed and improved, with a focus on enhancing the efficiency, soundness, and transparency of corporate management.

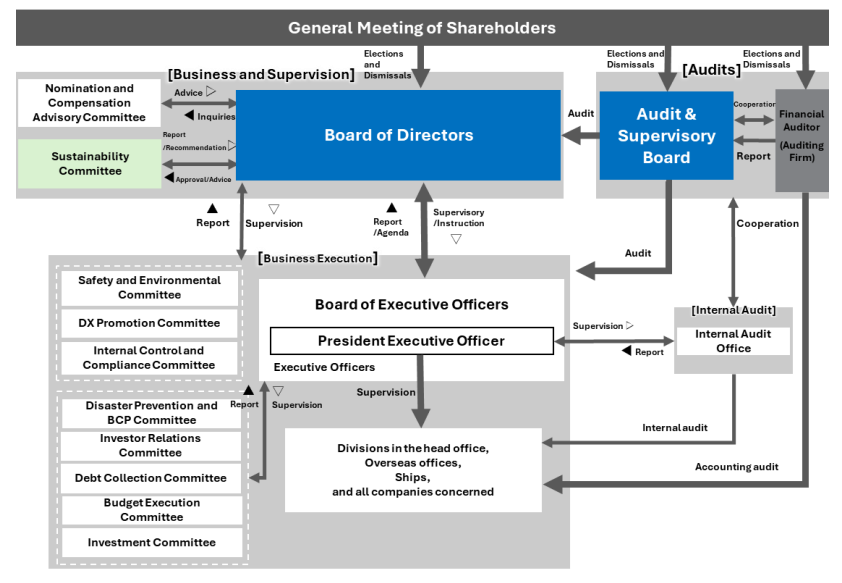

As a company with company auditors (board of company auditors) as defined in Japan’s Companies Act, the Company, to enhance its monitoring and supervisory functions and ensure the transparency and soundness of its corporate management, has established the Audit & Supervisory Board comprised of members duly authorized to monitor corporate management.

The majority of the Audit & Supervisory Board members are appointed from outside the Company. The Audit & Supervisory Board members supervise the execution of duties by Directors from an independent standpoint and cooperate with the independent accounting auditor and the Internal Audit Office. Furthermore, for the purpose of bolstering the neutrality, objectivity, and accountability of the Board of Directors, more than one third of its members are independent outside directors and the Nomination and Compensation Advisory Committee has been established to have the majority of its members being outside directors.

Looking to increase the transparency of management and enable a range of stakeholders to understand the Group’s management situation correctly, we are committed to enhancing information disclosure activities by disclosing accurate financial and non-financial information in a timely manner as well as in a way that is easy-to-understand, which exceeds both the legal requirements and the rules of financial instrument exchanges.

The Board of Directors, discusses and decides on basic policy and the most important matters connected with Group management. The Board of Directors decides matters guided by the law and the articles of incorporation and critical management issues defined in the discussion standards in our Regulations of Board of Directors. Furthermore, it is the body that supervises business operations. As a rule, the Board of Directors meets once per month.

The Board of Directors includes internal directors, including the chairperson, the president, and outside directors. Independent outside directors now account for more than one-third of the members.

In accordance with the basic policy decided on the Board of Directors, the Board of Executive Officers, as a rule, meets weekly to deliberate and decide on important matters related to business execution and management and to coordinate in advance the matters to be discussed by the Board of Directors. It includes executive officers selected by the Board of Directors, including the chairperson and the president /executive officer.

The Audit & Supervisory Board wields the authority required by law, organizes Audit & Supervisory Board meetings, defines auditing standards, and performs effective audits of the legality and the reasonableness of operations by directors, executive officers, and employees. Specifically, members attend meetings of the Board of Directors and the Board of Executive Officers, as well as important meetings and committee sessions. The Audit & Supervisory Board strives to identify management issues, to assess business conditions, to prevent violations of laws and the articles of incorporation, and performs accurate and effective audits.

The Nomination and Compensation Advisory Committee was established as an advisory body serving the Board of Directors to improve neutrality, objectivity, and accountability of the functions of the Board of Directors when making decisions on nominations and compensation for the directors.

The committee comprises six directors, including the president, the majority of whom are independent outside directors, and it is chaired by an independent outside director. The Committee members are selected based on a resolution of the Board of Directors.

The Company has established the following Independence Criteria for Outside Directors and Outside Auditors.

|

Skills required for the Board of Directors |

Skills expected of the board members |

|||||||||

|

Inside Director |

Outside Director |

|||||||||

|

Kazuma Yama- naka |

Noriko Miya- moto |

Toru Fujita |

Shinichi Kitazato |

Kiyoshi Kane- mitsu |

Setsu Onishi (Independent) |

Masako Yoshida (Independent) |

Keisuke Takega- hara (Independent) |

Riyo Kano (Independent) |

||

|

M |

Corporate manage- ment |

✓ |

✓ |

✓ |

✓ |

|||||

|

Market & business |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

||||

|

Worksite & technolo- gies (including ICT) |

✓ |

✓ |

✓ |

✓ |

||||||

|

I |

Accounting &Finance |

✓ |

✓ |

✓ |

||||||

|

Governance, Risk Manage- ment, Compliance |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|||

|

Human resources Manage- ment |

✓ |

✓ |

✓ |

✓ |

||||||

|

Sustaina- bility |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

|||

|

Customer Relations |

✓ |

✓ |

✓ |

|||||||

|

E |

Overseas assignment (global) |

✓ |

✓ |

✓ |

✓ |

|||||

|

Employ- ment at another company (Internal Director) |

✓ |

✓ |

||||||||

|

Manage- ment experience (Outside Director) |

✓ |

✓ |

||||||||

|

Title |

Name |

Board of Directors |

Audit and Supervisory Board |

Nomination and Compensation Advisory Committee |

||||

|

Attendance |

Attendance percentage (%) |

Attendance |

Attendance percentage (%) |

Attendance |

Attendance percentage (%) |

Committee |

||

|

Representative Director |

Kazuma Yamanaka |

14/14 |

100 |

- |

- |

6/6 |

100 |

✓ |

|

Directors |

Noriko Miyamoto |

14/14 |

100 |

- |

- |

- |

- |

- |

|

Directors |

Toru Fujita |

14/14 |

100 |

- |

- |

- |

- |

- |

|

Directors |

Shinichi Kitazato |

14/14 |

100 |

- |

- |

6/6 |

100 |

✓ |

|

Directors |

Kiyoshi Kanemitsu*¹ |

10/10 |

100 |

- |

- |

- |

- |

- |

|

Outside directors (Independent) |

Setsu Onishi |

14/14 |

100 |

- |

- |

6/6 |

100 |

✓ |

|

Outside directors (Independent) |

Masako Yoshida |

14/14 |

100 |

- |

- |

6/6 |

100 |

✓ |

|

Outside directors (Independent) |

Keisuke Takegahara*¹*² |

10/10 |

100 |

14/14 |

100 |

- |

- |

✓ |

|

Outside directors (Independent) |

Riyo Kano*³ |

- |

- |

- |

- |

- |

- |

✓ |

|

Audit & Supervisory Board Member(full-time) |

Toru Kihira*¹ |

10/10 |

100 |

14/14 |

100 |

- |

- |

- |

|

Audit & Supervisory Board Member(full-time) |

Soichi Miyazawa*³ |

- |

- |

- |

- |

- |

- |

- |

|

Outside Audit & Supervisory Board Member |

Shohei Yamamoto |

14/14 |

100 |

19/19 |

100 |

- |

- |

- |

|

Outside Audit & Supervisory Board Member |

Tomomi Mori*¹ |

10/10 |

100 |

14/14 |

100 |

- |

- |

- |

- Number of meetings of the Board of Directors, Nomination and Compensation Advisory Committee and the Board of Corporate Auditors since June 26, 2024.

- As he was appointed as a member of the Nomination and Compensation Advisory Committee on June 25, 2025, the number of his attendance is fewer.

- Attendance is not listed because he or she took office on June 25, 2025.

Every year since fiscal 2015, the Company has conducted a questionnaire administered to all directors and Audit & Supervisory Board Members in order to evaluate the effectiveness of the Board of Directors.

Identified Issues

- Management of the progress of the new medium-term business plan

- Further initiatives and materialization of DX

- Business operations in the transition period toward decarbonization

- Need to deepen discussions on vessel investment

- Further improvement regarding the operation of Board meetings in order to increase the quality of deliberations, such as by the preparation of concise and clear-cut agenda documents, sharing of information in advance, and provision of necessary materials

Efforts to Improve Effectiveness

- Certain improvements were made in the management of directors' deliberations, such as preparing concise materials, sharing information in advance, and providing necessary materials

Method of Evaluation

- As a new initiative, conducted a questionnaire survey by a third-party advisors

Results of Evaluation

- It was confirmed that the effectiveness of the Board of Directors of our company as a whole, including the composition, roles and operation of the Board of Directors, is generally ensured

- Strengths cited include the appointment of directors with diverse knowledge and the contribution to smooth business operations through prior explanations of materials

- In general, the governance system was evaluated to have been further expanded compared to the previous fiscal year

Identified Issues

- Further expansion of discussions on medium- to long-term

management strategies and risk management - Follow-up on matters resolved and reported at the Board of Directors

- Lack of opportunities for outside Directors and Auditors to deepen their understanding of the industry

- Further expansion of opportunities for understanding the company

- Continuing and further strengthening supervision of internal controls and the whistle-blowing system

Compensation for directors is designed to ensure consistency with management strategies so that it functions sufficiently as a sound incentive to enhance corporate value. Specifically, the compensation consists of fixed compensation, performance-based bonuses (executive bonuses) reflecting business performances for the fiscal year, and performance-based stock purchase compensation that reflects medium- and longterm increases in corporate value. Performance-based compensation, which consists of executive bonuses and stock purchase compensation, is designed to account for at most roughly 40% of total compensation.

Fixed compensation Fixed compensation is paid in cash each month, with a standard amount established based on the director's position, taking into consideration the capabilities and responsibilities required of directors in the shipping industry.

Performance-based executive bonuses Bonuses are linked to dividends per share and evaluations reflecting safe navigation performance for each term and are paid in cash as compensation linked to short-term performance. This is based on dividend policies and the assumption of paying a certain percentage or more special allowances (bonuses) to employees.

Share purchase compensation Share purchase compensation is paid as compensation linked to medium- and long-term performance. This compensation is linked to the degree of achievement of the medium-term business plan, such as operating income and return on equity (ROE), as well as overall evaluation that reflects the Company’s market capitalization and ESG indicators, etc. It aligns directors' interests with the interests of shareholders. Directors provide amounts equivalent to the stock purchase compensation they receive to the directors' shareholding association, purchasing stocks through the association.

Compensation for outside directors and Audit & Supervisory Board members Outside directors and Audit & Supervisory Board members are only paid fixed compensation since they are responsible for performing audits and providing advice regarding the Company and the entire Group's management from a position independent of business operations. Outside director compensation is decided by resolution of the Board of Directors, and Audit & Supervisory Board member compensation is decided through deliberation by Audit & Supervisory Board members.

Compensation for directors is determined by the Board of Directors based on inquiries to and advice from the Nomination and Compensation Advisory Committee. The Nomination and Compensation Advisory Committee examines the appropriateness of calculated executive compensation, and reports its findings to the Board of Directors. At the same time, the Board of Directors determines the amount of compensation for each individual director based on the report of the Nomination and Compensation Advisory Committee by confirming that the method and content of the decision are consistent with the decision policy resolved by the Board of Directors.

|

Directors |

Total fixed compensation (compensation for outside directors) |

¥207 million (¥32 million) |

10 persons (3 persons) |

|

Total performancebased compensation |

¥86 million |

5 persons |

|

|

Audit & Supervisory Board Members |

Total fixed compensation (compensation for outside Audit & Supervisory Board members) |

¥42 million (¥24 million) |

5 persons (4 persons) |

The total amount of fixed compensation for Directors and Audit & Supervisory Board members indicated above includes the amount paid to two Directors and two out of three Audit & Supervisory Board members who retired on June 26, 2024, at the close of the 98th Ordinary General Shareholders’ Meeting held on the same day. One unpaid Audit & Supervisory Board member who retired and one unpaid Audit & Supervisory Board member who is in office are not included in these figures.